Vikram and Pradnya share profits and losses in the ratio 2:3 respectively. Their balance sheet as on 31st March 2018 was as under.

Balance Sheet as on 31st March 2018

Liabilities | Amount (₹) | Assets | Amount (₹) |

Creditors | 1,05,000 | Cash | 7,500 |

Capitals : | Land & Building | 37,500 | |

Vikram | 75,000 | Plant | 45,000 |

Pradnya | 75,000 | Furniture | 3,000 |

Stock | 75,000 | ||

Debtors | 87,000 | ||

2,55,000 | 2,55,000 |

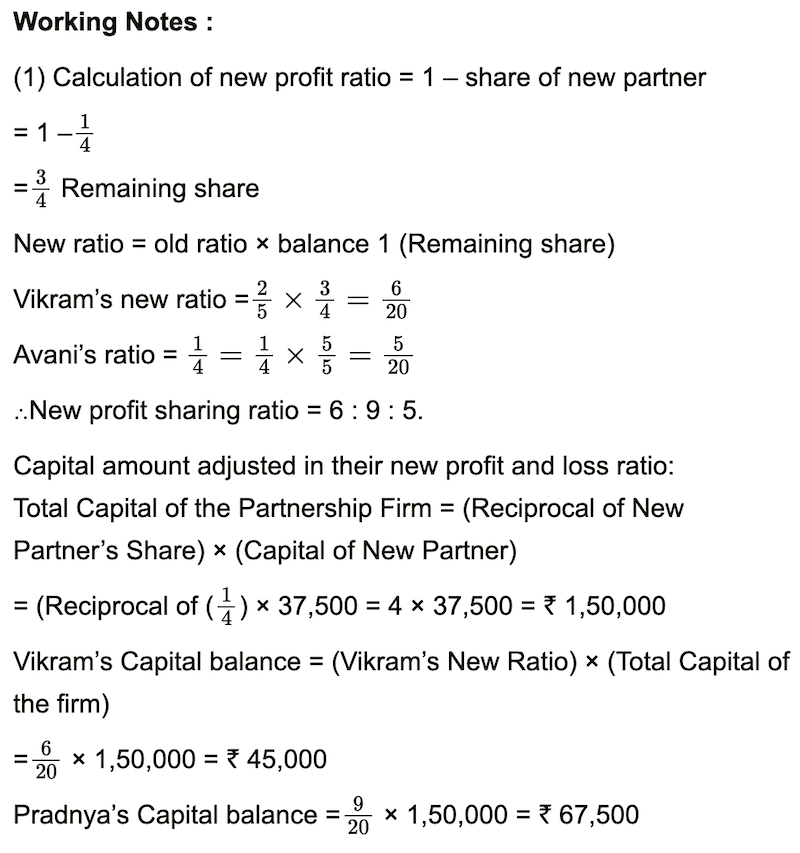

They agreed to admit Avani as a partner on 1st April 2018 on the following terms:

1 Avani shall have 1/4th share in future profits.

2. He shall bring ₹ 37,500 as his capital and ₹ 30,000 as his share of goodwill.

3. Land and building to be valued at ₹ 45,000 and furniture to be depreciated by 10%.

4. Provision for bad and doubtful debts is to be maintained at 5% on the Sundry Debtors.

5 Stocks to be valued ₹ 82, 500.

The capital A/c of all partners to be adjusted in their new profit and loss ratio and excess amount be transferred to their loan accounts.

Prepare Profit and Loss Adjustment Account, Capital Accounts, and New Balance Sheet.

Solution:

Dr | In the books of Partnership Firm Profit and Loss Adjustment Account | Cr | |||

Particulars | Amount (₹) | Particulars | Amount (₹) | ||

To R.D.D. A/c | 4,350 | By Land & Building A/c | 7,500 | ||

To Furniture A/c (Depreciation) | 300 | By Stock A /c | 7,500 | ||

To Profit on Revaluation | |||||

Vikram 4,140 | |||||

Pradnya 6,210 | 10,350 | ||||

15,000 | 15,000 | ||||

Dr | Partners’ Capital Accounts | Cr | |||||||

Particulars | Vikram (₹) | Pradnya (₹) | Avani (₹) | Particulars | Vikram (₹) | Pradnya (₹) | Avani (₹) | ||

To Partners’ Loan A/c | 46,140 | 31,710 | By Balance b/d | 75,000 | 75,000 | ||||

To Balance c /d | 45,000 | 67,500 | 37,500 | By Bank A/c | - | - | 37,500 | ||

By Revaluation A/c (Profit) | 4,140 | 6,210 | |||||||

By Goodwill A/c | 12,000 | 18,000 | |||||||

91,140 | 99,210 | 37,500 | 91,140 | 99,210 | 37,500 | ||||

Dr | Balance Sheet as on 1st April 2018 | Cr | |||||

Liabilities | Amount (₹) | Amount (₹) | Assets | Amount (₹) | Amount (₹) | ||

Capital Accounts: Vikram Pradnya Avani | 45,000 67,500 37,500 | 1,50,000 | Cash | 75,000 | |||

Creditors | 1,05,000 | Land & Building Add: Appreciation | 37,500 7,500 | 45,000 | |||

Partners’ Loan A/c : Vikram Pradnya | 46,140 31,710 | 77,850 | Furniture Less: Depreciation | 3,000 300 | 2,700 | ||

Plant | 45,000 | ||||||

Stock Add: Appreciation | 75,000 7,500 | 82,500 | |||||

Debtors Less : R.D.D. (5 %) | 87,000 4,350 | 82,650 | |||||

3,32,850 | 3,32,850 | ||||||

PRACTICAL PROBLEMS [PAGES 161 - 167]

Balbharati solutions for Book-keeping and Accountancy 12th Standard Hsc Maharashtra State Board Chapter 3 Reconstitution of Partnership (Admission of Partner) Practical Problems [Pages 161 - 167]

Practical Problems | Q 1 | Page 161

Practical Problems | Q 2 | Page 161

Practical Problems | Q 3 | Page 162

Practical Problems | Q 4 | Page 163

Practical Problems | Q 5 | Page 163

Practical Problems | Q 6 | Page 164

Practical Problems | Q 7 | Page 164

Practical Problems | Q 8 | Page 165

Practical Problems | Q 9 | Page 166

Practical Problems | Q 10 | Page 167

Select appropriate alternatives from those given below and rewrite the sentence.

Write a word/phrase/term which can substitute the following statement.

State True or False with reason.

Calculate the following.

Calculate the following.

Calculate the following.

Book-keeping and Accountancy 12th Standard

HSC Maharashtra State Board. Latest Syllabus.

Chapter 1: Introduction to Partnership and Partnership Final Accounts

Chapter 2: Accounts of ‘Not for Profit’ Concerns

Chapter 3: Reconstitution of Partnership (Admission of Partner)

Chapter 4: Reconstitution of Partnership (Retirement of Partner)

Chapter 5: Reconstitution of Partnership (Death of Partner)

Chapter 6: Dissolution of Partnership Firm

Chapter 8: Company Accounts - Issue of Shares

Chapter 9: Analysis of Financial Statements

Chapter 10: Computer In Accounting

ACCOUNTS BOARD PAPERS

HSC Accounts March 2020 Board Paper With Solution

MARCH 2014 : View | PDF Download

OCTOBER 2014 View | PDF Download

MARCH 2015 View | PDF Download

JULY 2015 View | PDF Download

MARCH 2016 View | PDF Download

JULY 2016 View | PDF Download

JULY 2017 View | PDF Download

MARCH 2017 View | PDF Download

MARCH 2018 View | PDF Download

JULY 2018 View | PDF Download

MARCH 2019 View | PDF Download

MARCH 2020 View | PDF Download