Balbharati solutions for Book-keeping and Accountancy 12th Standard HSC Maharashtra State Board

Chapter 7 - Bills of Exchange [Latest edition]

Select the correct option and rewrite the sentence:-

The person on whom a bill is drawn is called a________________.

Drawee

Payee

Drawer

Acceptor

Before acceptance the bill is called a________________.

Order

Request

Draft

Instrument

When the due date of bill drawn falls due on a public holiday, the payment must be made on the_____________ day.

Same

Preceding

Next

Any

The due date of the bill drawn for 2 months on 23rd Nov. 2019 will be______________.

23rd Jan. 2020

25th Jan. 2019

26th Jan. 2019

25th Jan. 2020

Nothing charges are borne by__________________.

Notary public

Drawee

Drawer

Endorsee

There are _______________ parties to bill of exchange.

Five

Four

Three

Two

When a bill is drawn for 2 months after date on 3rd Jan. 2020, its due date will be__________________.

3rd Jan. 2020

3rd Mar. 2020

5th Jan. 2020

6th Mar. 2020.

Notary Public is_________________.

Govt. officer

Drawer

Payee

Endorsee

When Acceptor or Drawee does not pay the amount of bill to the holder on the due date it is known as_____________ the bill.

Returning

Discounting

Honouring

Dishonouring

The person who accepts the bill treats the bill as___________.

Bills payable

Promissory note

Draft

Bills receivable

Give one word/phrase/term which can substitute the following statement:-

Three extra days which are allowed over and above the term of bill.-

Grace days.

Fees charged by Notary Public for getting the fact of dishonour noted. - Noting Charges.

Amount which is not recoverable from Drawee on account of insolvency. - Bad debts.

A person who is entitled to receive the amount of bill of exchange - Payee.

A person in whose favour a bill endorsed. - Endorsee.

Officer appointed by government for noting of dishonour of bill. - Notary Public.

Cancellation of bill on maturity in return of a new bill for extended period of credit. - Renewal of Bill.

Bill of exchange drawn and accepted without any valuable consideration. - Accommodation bill.

Person who is in possession of Bill of Exchange. - Holder.

Conversion of Bill of Exchange into its present value. - Discounting of the bill.

State True or False with reason:-

Inland bill is one which is drawn in one country and payable in another country. - False.

Reason

Inland bill means, a bill drawn, accepted, and made payable within the territory of one and the same, country. So, a bill is drawn in one country and payable in another country can’t be a inland bill.

Retirement of bill means payment of the bill before due date. - True

Reason

Payment of the bill, by the acceptor of the bill to the holder of the bill before the due date, is known as Retirement of the bill. So retirement of the bill means payment of the bill before the due date.

Drawee can transfer the ownership of the bill. - False

Reason

Drawee is a debtor. He has to pay the amount of the bill to its holder on the due date. Hence he cannot transfer its ownership to another person. Drawer can transfer the ownership of the bill as he is the owner of the bill.

Acceptance of bills without making any changes in the terms of the bill is called qualified acceptance. - False.

Reason

Acceptance of the bill with some changes as regards the terms, amount, place, etc. of a bill is known as qualified acceptance. Acceptance of the bill without making changes as regards the term is called general acceptance.

Discounting is a device to convert the bill into its present value. - True.

Reason

When the drawer or holder of the bill approaches the bank to discount the bill, the bank pays the bill amount after deducting a certain amount (which is known as discounting charges). It means the conversion of the bill into its present value in cash. So, we can say that discounting is a device to convert the bill into its present value.

A bill of exchange must be presented to the acceptor on the due date. - True.

Reason..

To get the payment of the bill from the acceptor, the holder of the bill is required to present it to the acceptor on its due date. Acceptor either honours the bill or dishonours the bill.

If a bill is discounted by the holder, no entry is passed in his book when the bill is honoured on the due date. - True.

Reason

On discounting the bill the holder gives the possession of the bill to the bank. On the maturity date, the bank has to present the bill to the drawee to collect the payment. When discounted bill is honoured, the transaction takes place between drawee and bank.

Noting charges are to be borne by the drawer. - False.

Reason

Noting charges are to be borne by the drawee only as due to his act of non-payment, the bill is dishonoured and the drawer is not able to get money on its due date.

If a bill is drawn payable ‘on-demand’ no grace days are allowed. - True.

Reason

‘On-demand’ means the amount of the bill is to be paid by drawee immediately on presentation of the bill as no time period is mentioned on it. In demand bill 3 days grace are not allowed by law.

There are three parties to a promissory note. - False

Reason

There are only two parties to a promissory note, i.e. Drawer or maker of the note and drawee or payee of the note.

Find the odd one:-

Retaining

Noting

Discounting

Endorsing

Trade bill

Accommodation bill

After date bill

Demand bill

Notary Public

Drawer

Drawee

Payee

Discounting charges

Rebate

Bank charges

Noting charges.

Stamp

Acceptance

Draft

Amount

Complete the sentence:-

Making payment of bill before the due date of maturity is known as Retirement of Bill.

Person whose liabilities are more than his assets and is not in position to pay off his liabilities is Insolvent person.

Amount that cannot be paid by acceptor on account of insolvency is known as deficiency.

A bill of exchange payable after certain period is known as after date bill.

A bill which is drawn and accepted with valuable consideration is known as Trade Bill

A person who draws the bill of exchange is known as Drawer.

A bill whose due date is calculated from the date of acceptance is known an After sight bill.

Recording the fact of dishonour of Bill is known as Noting.

When Drawee accepts the bill payable at a particular place only, it is known as qualified acceptance as to place

Fees charged by the bank for collection of bill on behalf of holder is bank charges.

Answer in sentence: -

What do you mean by bill of exchange?

A Bill of Exchange is a written order signed by the drawer, directing to a certain person to pay a certain sum of money on-demand or on a certain future date to a certain person or as per his order.

What are days of grace?

The three extra days allowed to the drawee or the acceptor of a bill for making payment on it are called Days of Grace.

What do you mean by discounting a bill of exchange?

Encashment of a bill of exchange with the bank for certain cash which is less than the face value of the bill, before its due date by its drawer or holder is called Discounting of a Bill of Exchange.

What is noting of the bill?

Noting of a Bill of Exchange is the recording the facts of its dishonour by a Notary public.

What are noting charges?

Noting Charges are the fees charged by the Notary public for noting the facts of dishonour on the face of the bill and in his official register.

What is relationship between Drawer and Drawee?

The relationship between the drawer and the drawee is that of the creditor and debtor.

Who is payee of the bill?

The Payee of a Bill is the person to whom the bill is made payable or in whose favour the bill is draw

What do you mean by rebate?

Any concession or discount in monetary terms given by the holder of the bill of exchange to the drawee or acceptor, when a bill is retired is called Rebate.

What is legal due date?

Date which is arrived at after adding three days of grace to nominal due date is known as Legal Due Date.

What is bills payable on demand?

When amount of bill is payable by a drawee on the presentation of a bill, in which time period is not mentioned and grace days are not allowed is known as Bills Payable on Demand.

Do you agree or disagree with the following statement : -

A bill of exchange is a conditional order. - Disagree

The party which is ordered to pay the amount is known as the payee. - Disagree

The person in whose favour the bill is endorsed is known as endorsee. - Agree

Rebate or discount given on retiring a bill is an income to the Drawee. - Agree

A bill from the point of view of debtor is called Bills payable. - Agree

In case of bill drawn payable ‘on-demand,’ no grace days are allowed. - Agree

A bill is required to be accepted by Drawer - Disagree

A bill of exchange need not be dated. - Disagree

A bill before acceptance is called Promissory Note. - Disagree

Renewal is request by Drawee to extend the credit period of the bill. – Agree

Calculation:-

Ganesh draws a bill for ₹ 40,260 on 15th Jan. 2020 for 50 days. He discounted the bill with Bank of India @15% p.a. on the same day. Calculate the amount of discount.

Solution:

Discount = Amount of Bill × (Rate/100) × (Unexpired days/366)

∴ Discount = 40260 × (15/100) × (50/366)

∴ Discount = ₹ 825

(Note: 2020 is a Leap year, so total number of days = 366 days)

Calculation:-

Shefali Traders drew a bill on Maya for ₹ 30,000 on 1st Oct. 2019 payable after 3 months. Calculate amount of discount in the following cases:

i) Shefali Traders discounted the bill on the same day @ 12% p.a.

ii) Shefali Traders discounted the bill on 1st Nov. 2019 @ 12% p.a.

iii) Shefali Traders discounted the bill on 1st Dec. 2019 @ 12% p.a.

Solution:

Discount = Amount of Bill × (Rate/100) × (Unexpired days/366)

(i) Discount = 30000 × (12/100) × (3/12) = ₹ 900

(ii) Discount = 30000 × (12/100) × (2/12) = ₹ 600

(iii) Discount = 30000 × (12/100) × (1/12) = ₹ 300

Calculation:-

Veena who had accepted Sudha’s bill for ₹ 28,000 was declared bankrupt and only 35 paise in a rupee could be recovered from her estate. Calculate the amount of bad debts.

Solution:

From Veena, only 35 paise in a rupee could be recovered i.e. 65 paise in a rupee is bad debts for Sudha.

So 65 % of ₹ 28,000

= ₹ 18,200 is the amount of bad debts.

Calculation:-

Nitin renewed his acceptance for ₹ 72,000 by paying ₹ 22,000 in cash and accepting a new bill for the balance plus interest @ 18% p.a. for 4 months. Calculate the amount of new bill.

Solution:

For Nitin, Total outstanding | ₹ 72,000 |

Nitin paid in cash | ₹ 22,000 |

Remaining dues | ₹ 50,000 |

Now, on this ₹ 50,000 we have to calculate interest @ 18 % for 4 months.

Interest = (PRN)/100

∴ Interest = 50000 × (18/100) × (4/12)

∴ Interest = ₹ 3,000

So, amount of new bill = Remaining dues + Interest

= 50,000 + 3,000

= ₹ 53,000.

Calculation:-

Nisha’s acceptance for ₹ 16,850 sent to bank for collection was honoured and bank charges debited were ₹ 125. Find out the amount actually received by Drawer.

Solution:

Bill of ₹ 16,850 sent to bank for collection and it is honoured and bank charges = ₹ 125

So, actual amount received by drawer = 16,850 – 125

= ₹ 16,725.

Calculation:-

A bill of ₹16,000 was drawn by Keshav on Gopal on 12th June 2019 for 2 months. What will be the due date, if all of sudden, the legal due date is declared as an emergency holiday?

Solution:

Consider immediate or next working day as due date in case the legal due date is declared as emergency holiday.

i.e. Here, it is 12th June, 2019 | 12/06/2019 | |

+ 2 months | + | 2 |

+ 3 days of grace | + | 3 |

15/08/2019 | ||

∴ Legal due date is 16th August 2019 (Next day).

Prepare a bill of exchange form the following information:

Drawer: Shankar, Vadodara, Gujrat.

Drawee: Vinayak, Somwar peth, Pune.

Amount : ₹ 16,000

Period : 3 months

Date of Bill: 6th Sept. 2019.

Date of acceptance: 11th Sept. 2019.

![Drawer: Shankar, Vadodara, Gujrat. Drawee: Vinayak, Somwarpeth, Pune. Amount : ₹ 16,000 Period : 3 months Date of Bill: 6th Sept. 2019. Date of acceptance: 11th Sept. 2019. - Book Keeping and Accountancy LoginCreate free account Course HSC Commerce (Marketing and Salesmanship) 12th Board Exam Maharashtra State Board Home Search Online Classes My Profile[view full profile] why create a profile on Shaalaa.com? 1. Inform you about time table of exam. 2. Inform you about new question papers. 3. New video tutorials information. Drawer: Shankar, Vadodara, Gujrat. Drawee: Vinayak, Somwarpeth, Pune. Amount : ₹ 16,000 Period : 3 months Date of Bill: 6th Sept. 2019. Date of acceptance: 11th Sept. 2019. - Book Keeping and Accountancy LoginCreate free account Course HSC Commerce (Marketing and Salesmanship) 12th Board Exam Maharashtra State Board Home Search Online Classes My Profile[view full profile] why create a profile on Shaalaa.com? 1. Inform you about time table of exam. 2. Inform you about new question papers. 3. New video tutorials information.](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh1nSJuR8CmhE4cN5VMC90gfATcjNxnuGjATx31MXQWfXFuwn70X1exaAX1dv8E3dDnQJihRCV54I5ldQpXSMJxojEeGfvogwOAeuMsjtIkgtixMPwQ4cereSBQj7scpmpKK0X10TyXhaU/s16000-rw/Slide1.jpeg) |

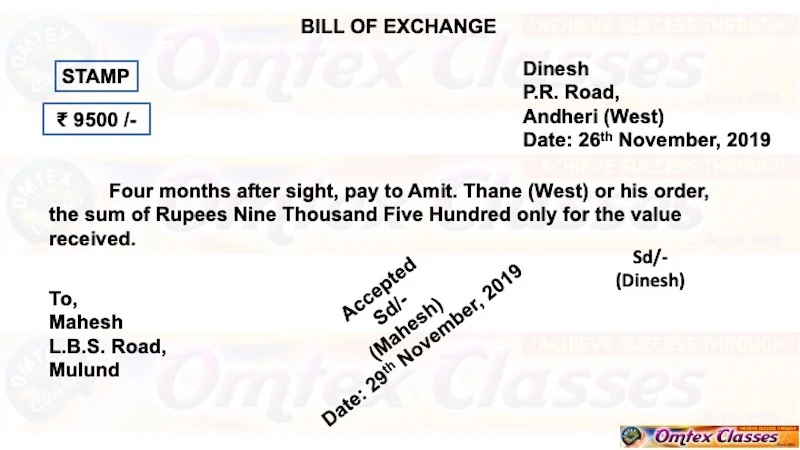

Prepare a bill of exchange from the following information:

Drawer: Dinesh, P. R. Road, Andheri West.

Drawee: Mahesh, L. B. S. Road, Mulund.

Payee: Amit, Thane West.

Amount: ₹ 9,500

Period of Bill: 4 months after sight.

Date of Bill: 26th Nov. 2019.

Date of acceptance: 29th Nov. 2019.

|

| Prepare a bill of exchange from the following information |

Kantilal, 343/D, Palm Heights, Jogeshwari, drew a bill on 10th Oct. 2019 for ₹63,490 for 45 days after date on Shantilal, B2, Himalaya Towers, Baramati, payable to Priyanka, Satara. The bill was accepted on 13th Oct. 2019 for 60 days.

Prepare a format of bill of exchange from the above details.

Prepare a format of bill of exchange from the above details

Prepare a format of bill of exchange from the above details

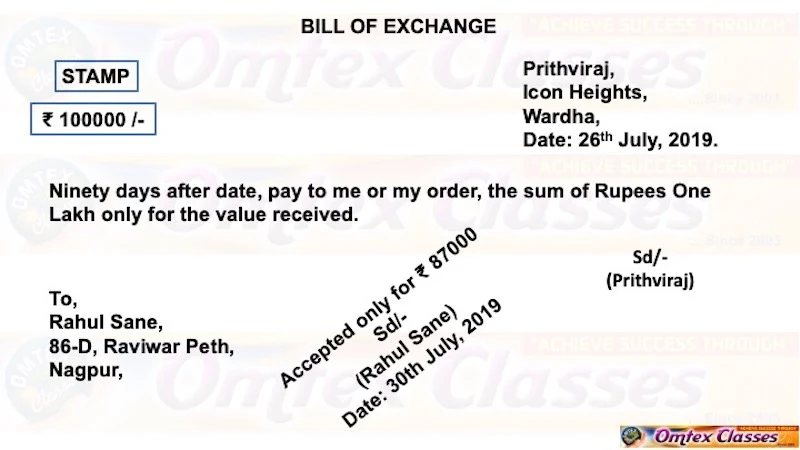

Prepare a format of bill exchange from the following details :

Rahul Sane, 86-D, Raviwar Peth, Nagpur accepted the bill drawn on him by Prithviraj, Icon Heights, Wardha for ₹ 87,000 on 30th July 2019. The bill was drawn on 26th July 2019 for ₹ 1,00,000 for 90 days after date.

|

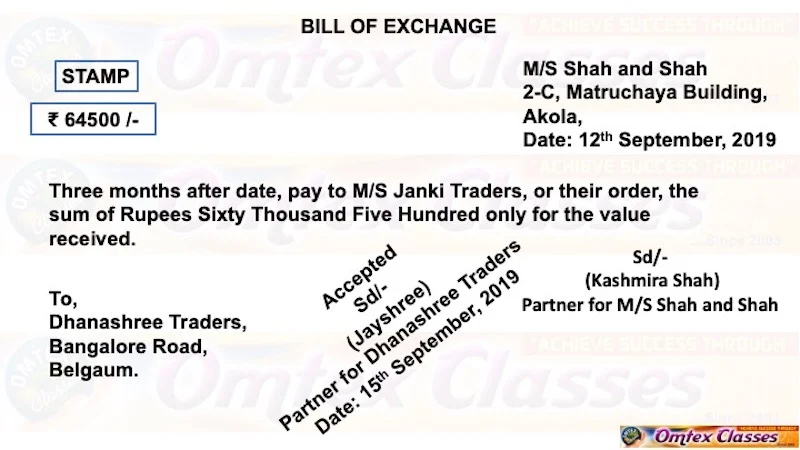

Prepare a format of bill of exchange from the following.

Drawer: Kashmira Shah, Partner M/S Shah and Shah, 2-C, Matruchaya Building, Akola. Drawee: Dhanashree Traders, Bangalore Road, Belgaum. (Signed by Jayashree, Partner) Payee: M/S Janki Traders, Akola.

Amount : ₹ 64,500

Period of Bill : 3 months

Date of drawing: 12th Sept. 2019

Date of acceptance: 15th Sept. 2019

|

Prepare a demand bill with imaginary Drawer, Drawee, Address, Amount, and Date.

|

Exercise - 7 | Q 1 | Page 305

Complete the following Table

Date of Drawing | Date of Acceptance | Payable | Due Date |

30.1.2019 | 1.2.2019 | 60 days after date | |

17.8.2019 | 21.8.2019 | 3 months after sight | |

23.12.2019 | 26.12.2019 | 1 months after date | |

28.1.2019 | 28.1.2020 | 1 months after date | |

30.6.2019 | 2.7.2019 | 45 days after date |

Solution:

Date of Drawing | Date of Acceptance | Payable | Due Date |

30.1.2019 | 1.2.2019 | 60 days after date | 3rd April 2019 |

17.8.2019 | 21.8.2019 | 3 months after sight | 24th Nov. 2019 |

23.12.2019 | 26.12.2019 | 1 months after date | 25h Jan. 2019 |

28.1.2019 | 28.1.2020 | 1 months after date | 2nd Mar. 2019 |

30.6.2019 | 2.7.2019 | 45 days after date | 17th Aug. 2019 |

Exercise - 7 | Q 2 | Page 305

Complete the following Table

Sr. No | Date of drawing | acceptance | Tenure | Type | Nominal due date | Legal due date |

1 | 3rd January 2020 | 5th January 2020 | 45 days | after date | ? | ? |

2 | 9th April 2019 | 12th April 2029 | 4 months | After sight | ? | ? |

3 | 23rd November 2019 | 23rd November 2029 | 2 months | after date | ? | ? |

4 | 16th August 2019 | 20th August 2019 | 4 months | After sight | ? | ? |

5 | 23rd December 2018 | 24th December 2018 | 60 days | after date | ? | ? |

Solution:

Sr. No | Date of drawing | Date of acceptance | Tenure | Type | Nominal due date | Legal due date |

1 | 3rd January 2020 | 5th January 2020 | 45 days | after date | 17th Feb. 2020 | 20th Feb. 2020 |

2 | 9th April 2019 | 12th April 2029 | 4 months | After sight | 12th Aug. 2019 | 14th Aug. 2019 |

3 | 23rd November 2019 | 23rd November 2029 | 2 months | after date | 23rd Jan. 2020 | 25th Jan. 2020 |

4 | 16th August 2019 | 20th August 2019 | 4 months | After sight | 20th Dec. 2019 | 23rd Dec. 2019 |

5 | 23rd December 2018 | 24th December 2018 | 60 days | after date | 21st Feb. 2019 | 24th Feb. 2019 |

[7] Bills of Exchange - Practical problem - (Balbharati Book Keeping and Accountancy 12th Board Exam)

On 1st Jan. 2020 Hemant sold goods of ₹ 18,500 to Nitin. On the same date, Hemant drew a bill of exchange for ₹ 18,500 at 2 months. On the due date, the bill was duly honoured.

Give Journal Entries in the Books of Hemant and Nitin. Prepare Hemant’s account in the books of Nitin.

Solution:

In the books of Hemant

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2020 Jan. 1 | Nitin’s A/c Dr | 18,500 | ||

To Sales A/c | 18,500 | |||

(Being goods sold on credit) | ||||

2020 Jan. 1 | Bills Receivable A/c Dr | 18,500 | ||

To Nitin’s A/c | 18,500 | |||

(Being bill drawn and acceptance received from Nitin) | ||||

2020 Mar. 4 | Cash / Bank A/c Dr | 18,500 | ||

To Bills Receivable A/c | 18,500 | |||

(Being Nitin’s acceptance honoured on the due date) | ||||

55,500 | 55,500 |

In the books of Nitin

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2020 Jan. 1 | Purchase A/cDr | 18,500 | ||

To Hemant’s A/c | 18,500 | |||

(Being goods purchased on credit) | ||||

2020 Jan. 1 | Hemant’s A/c Dr | 18,500 | ||

To Bills Payable A/c | 18,500 | |||

(Being our acceptance is given) | ||||

2020 Mar. 4 | Bills Payable A/c Dr | 18,500 | ||

To Cash / Bank A/c | 18,500 | |||

(Being our acceptance honoured on due date) | ||||

55,500 | 55,500 |

In the books of Nitin.

Hemant’s Account

Date | Particulars | J.F | Amount (₹) | Date | Particulars | J.F | Amount (₹) |

2020 Jan. 1 | To Bills Payable A/c | 18,500 | 2020 Jan. 1 | By Purchase A/c | 18,500 | ||

18,500 | 18,500 |

Neha sold goods to Rohan's ₹42,000 on 6th Sept. 2019. Neha drew a bill of exchange at 3 months for the amount which was accepted by Rohan. Neha disounted the bill with her bankers at ₹ 41,000. On the due date of the bill, Rohan dishonoured the bill and bank paid ₹ 300 as Noting Charges

Show Journal Entries in the Books of Neha and Rohan.

In the books of Neha

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2019 Sept. 6 | Rohan’s A/c Dr | 42,000 | ||

To Sales A/c | 42,000 | |||

(Being goods sold on credit) | ||||

2019 Sept. 6 | Bills Receivable A/c Dr | 42,000 | ||

To Rohan’s A/c | 42,000 | |||

(Being bill drawn and acceptance received) | ||||

2019 Sept. 6 | Bank A/c Dr | 41,000 | ||

Discount A/c Dr | 1,000 | |||

To Bills Receivable A/c | 42,000 | |||

(Being Rohan’s acceptance discounted with bank) | ||||

Dec. 9 | Rohan’s A/c Dr | 42,300 | ||

To Bank A/c | 42,300 | |||

(Being Rohan’s acceptance discounted with bank dishonoured and noting charges paid by the bank.) | ||||

1,68,300 | 1,68,300 |

In the books of Rohan

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2019 Sept. 6 | Purchase A/c Dr | 42,000 | ||

To Neha’s A/c | 42,000 | |||

(Being goods purchased on credit) | ||||

2019 Sept. 6 | Neha’s A/c Dr | 42,000 | ||

To Bills Payable A/c | 42,000 | |||

(Being our acceptance given) | ||||

2019 Sept. 6 | Bills Payable A/c Dr | 42000 | ||

Noting Changes A/c Dr | 300 | |||

To Neha’s A/c | 42300 | |||

(Being our acceptance dishonoured and noting charges payable) | ||||

126300 | 126300 |

Jyoti owes ₹ 31,000 to Swati for which was draws a bill on Jyoti for 2 months. The bill was duly accepted by Jyoti. Swati sends the bill to bank for collection. Jyoti honoured the bill on the due date and bank charges ₹ 475 as bank charges.

Give Journal Entries in the Books of Swati.

In the books of Swati

Journal Entries

Date | Particulars | LF | Debit (₹) | Credit (₹) |

1 | Bills Receivable A/c Dr | 31,000 | ||

To Jyoti’s A/c | 31,000 | |||

(Being bill drawn and acceptance received) | ||||

2 | Bills Sent to Bank for Collection A/c Dr. | 31,000 | ||

To Bills Receivable A/c | 31,000 | |||

(Being bill sent to bank for collection) | ||||

3 | Bank A/c Dr | 30,525 | ||

Bank Charges A/c Dr | 475 | |||

To Bill Sent to Bank for Collection A/c | 31,000 | |||

(Being bill honoured and bank charges paid) | ||||

93000 | 93000 |

Pankaj purchased goods of ₹ 20,000 from Omprakash on credit on 15th April 2019. Omprakash draws After Sight bill for the amount due on Pankaj for 3 months which was accepted by Pankaj on 18th April, 2019. On 20th April, 2019 Omprakash endorsed the bill to his creditor Jagdish in full settlement of his amount₹ 21,000. On the due date, the bill was dishonoured by Pankaj.

Give Journal Entires in the Books of Omprakash, Pankaj and Jagdish.

In the books of Omprakash

Journal Entries

Date | Particulars | L.F | Debit (₹ ) | Credit (₹) |

2019 April 15 | Pankaj’s A/c Dr | 20,000 | ||

To Sales A/c | 20,000 | |||

(Being goods sold on credit) | ||||

2019 April 18 | Bills Receivable A/c Dr. | 20,000 | ||

To Pankaj’s A/c | 20,000 | |||

(Being bill drawn and acceptance received) | ||||

2019 April 20 | Jagdish’s A/cDr | 21,000 | ||

To Bills Receivable A/c | 20,000 | |||

To Discount A/c | 1,000 | |||

(Being Pankaj’s acceptance endorsed) | ||||

July 23 | Pankaj’s A/c Dr | 20,000 | ||

Discount A/c Dr | 1000 | |||

To Jagdish’s A/c | 21,000 | |||

(Being Pankaj’s acceptance dishonoured and revert the Jagdish’s A/c) | ||||

82000 | 82000 |

In the books of Pankaj

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2019 April 15 | Purchase A/c Dr. | 20,000 | ||

To Omprakash’s A/c | 20,000 | |||

(Being goods purchased on credit) | ||||

2019 April 18 | Omprakash’s A/c Dr | 20,000 | ||

To Bills Payable A/c | 20,000 | |||

(Being our acceptance is given) | ||||

2019 April 20 | No Entry | - | - | |

July 23 | Bill Payable A/c Dr | 20,000 | ||

To Omprakash’s A/c | 20,000 | |||

(Being our acceptance dishonoured on due date) | ||||

60,000 | 60,000 |

In the books of Jagdish

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2019 April 20 | Bills Receivable A/c Dr. | 20,000 | ||

Discount A/c Dr | 1000 | |||

To Omprakash’s A/c | 21,000 | |||

(Being Bills Receivable received) | ||||

July 23 | Omprakash’s A/c Dr | 21,000 | ||

To Bills ReceivableA/c | 20,000 | |||

To Discount A/c | 1000 | |||

(Being Bills receivable dishonoured) | ||||

42000 | 42000 |

Siddhant sold goods to Sudhir of ₹ 43,800 on 18th March 2019. Siddhant draws a bill on Sudhir on the same day for ₹ 43,800 for 3 months which was duly accepted by Sudhir. Siddhant discounted the bill on the same day at 8% p.a. the bill was dishonoured on the due date and Sudhir requested Siddhant to accept ₹ 13,800 and interest in cash on remaining amount at 12% p.a. Siddhant agreed and for the balance, the amount accepted a new bill at 2 months. Before the due date of new bill, Sudhir retired the bill by paying ₹ 29,700.

Pass necessary Journal Entries in the Books of Siddhant.

In the books of Siddhant

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹ ) |

2019 Mar. 18 | Sudhir’s A/c Dr | 43,800 | ||

To Sales A/c | 43,800 | |||

(Being goods sold on credit) | ||||

2019 Mar. 18 | Bills Receivable A/c Dr. | 43,800 | ||

To Sudhir’s A/c | 43,800 | |||

(Being bill drawn and acceptance received | ||||

2019 Mar. 18 | Cash / Bank A/c Dr | 42,924 | ||

Discount A/c Dr | 876 | |||

To Bill Receivable A/c | 43,800 | |||

(Being Sudhir’s acceptance discounted with bank) | ||||

June 21 | Sudhir’s A/c Dr | 43,800 | ||

To Cash / Bank A/c | 43,800 | |||

(Being Sudhir’s acceptance dishonoured on due date) | ||||

June 21 | Cash A/c Dr | 14,400 | ||

To Interest A/c | 600 | |||

To Sudhir’s A/c | 13,800 | |||

(Being cash accepted with interest from Sudhir) | ||||

June 21 | New Bills Receivable A/c Dr | 30,000 | ||

To Sudhir’s A/c | 30,000 | |||

(Being Sudhir’s acceptance received for new bill) | ||||

- | Cash / Bank A/c Dr. | 29,700 | ||

Rebate A/c Dr. | 300 | |||

To New Bills Receivable A/c | 30,000 | |||

(Being before due date, Sudhir’s retired the bill with discount) | ||||

249600 | 249600 |

Working Notes :

(1) March 18, Discount = 43800 × (3/12) × (8/100) = ₹ 876

(2) March 21, Calculation of interest balance amount:

Interest = (PNR)/100 = ₹ 30000 × 1(12/100) × (2/12)

[For 2 months on remaining amount of ₹ 30000] = ₹ 600

(3) Before due date bill was retired by Sudhir by paying ₹ 300 less which is considered as discount and as date is not given, here it is not recorded.

Sangeeta accepted a bill for ₹ 18,000 drawn by Geeta at 3 months. Geeta discounted the bill for ₹ 17,400. Before the due date Sangeeta approached Geeta for renewal of the bill. Geeta agreed on the condition that Sangeeta should pay ₹ 6,000 immediately and for the balance, she should accept a new bill for 4 months along with interest ₹ 550. The arrangements were carried through. But on the due date of new bill Sangeeta became insolvent and 35 paise in a rupee could be recovered from her estate.

Give Journal Entries in the Books of Sangeeta and prepare Sangeeta’s account in the books of Geeta.

In the books of Sangeeta

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

1 | Geeta’s A/c Dr | 18,000 | ||

To Bill Payable A/c | 18,000 | |||

(Being our acceptance is given) | ||||

2 | Bills Payable A/c Dr | 18,000 | ||

To Geeta’s A/c | 18,000 | |||

(Being bill cancelled on our request) | ||||

3 | Geeta’s A/c Dr | 6,000 | ||

To Bank A/c | 6,000 | |||

(Being part payment made) | ||||

4 | Interest A/c Dr | 550 | ||

To Geeta’s A/c | 550 | |||

(Being the interest due on balance amount to be paid) | ||||

5 | Geeta’s A/c Dr | 12,550 | ||

To New Bills Payable A/c | 12,550 | |||

(Being the acceptance given for balance amount plus amount of interest) | ||||

6 | New Bills Payable A/c Dr | 12,550 | ||

To Geeta’s A/c | 12,550 | |||

(Being new bill dishonoured) | ||||

7 | Geeta’s A/c Dr | 12,550 | ||

To Cash A/c | 4,393 | |||

To Deficiency A/c | 8,157 | |||

(Being 35 % of the amount due paid and balance credited to deficiency A/c) | ||||

80200 | 80200 |

In the books of Geeta Sangeeta’s Account

Dr | Cr | ||||||

Date | Particulars | J.F | Amount (₹) | Date | Particulars | J.F | Amount (₹) |

- | To Balance b / d | 18,000 | 1 | By Bill Receivable A/c (Acceptance received) | 18,000 | ||

3 | To Bank A/c (Dishonour) | 18,000 | 4 | By Bank A/c (Part payment | 6000 | ||

5 | To Interest A/c (Int. due) | 550 | 6 | By Bills Receivable A/c (New acceptance) | 12,550 | ||

7 | To Bills Receivable A/c (Dishonour) | 12,550 | 8 | By Cash A/c | 4,393 | ||

By Bad debts A/c | 8,157 | ||||||

49,100 | 49,100 |

Working Notes :

(1) It is advisable to write journal entries in the books of Geeta also to get entries in ‘Sangeeta’s Account’ property.

In the books of Geeta

Journal Entries

Date | Particulars | L.F | Debit (₹) | credit (₹) |

1 | Bills Receivable A/c Dr. | 18,000 | ||

To Sangeeta’s A/c | 18,000 | |||

2 | Bank A/c Dr. | 17,400 | ||

Discount A/c Dr | 600 | |||

To Bills Receivable A/c | 18,000 | |||

3 | Sangeeta’s A/c Dr | 18,000 | ||

To Bank A/c (Cancellation of discounted bill) | 18,000 | |||

4 | Bank A/c Dr | 6,000 | ||

To Sangeeta’s A/c | 6,000 | |||

5 | Sangeeta’s A/c Dr | 550 | ||

To Interest A/c | 550 | |||

6 | Bills Receivable A/c Dr. | 12,550 | ||

To Sangeeta’s A/c | 12,550 | |||

7 | Sangeeta’s A/c Dr | 12,550 | ||

To Bills Receivable A/c | 12,550 | |||

8 | Cash A/c Dr | 4,393 | ||

Bad debts A/c Dr | 8,157 | |||

To Sangeeta’s A/c | 12,550 | |||

98200 | 98200 |

Priyanka owed Meena ₹ 18,000, Priyanka accepted a bill drawn Meena for the amount at 4 months. Meena endorsed the same bill to Sagar. Before due date Priyanka approached Meena for renewal of bill. Meena agreed on condition that ₹ 6,000 be paid immediately together with interest on the remaining amount of 8 % p. a. for 3 months and Priyanka should accept a new bill for the balance amount. These arrangements were carried through. However, before the due date, Priyanka became insolvent and only 50 % of the amount could be recovered from her estate.

Give Journal Entries in the Books of Meena.

In the books of Meena

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

1 | Bills Receivable A/c Dr. | 18,000 | ||

To Priyanka’s A/c | 18,000 | |||

(Being bill drawn and acceptance is received) | ||||

2 | Sagar’s A/c Dr | 18,000 | ||

To Bills Receivable A/c | 18,000 | |||

(Being bill endorsed in favour of Sagar) | ||||

3 | Priyanka’s A/c Dr. | 18,000 | ||

To Sagar’s A/c | 18,000 | |||

(Being the bill cancelled at the request of Priyanka) | ||||

4 | Cash A/c Dr | 6,240 | ||

To Interest A/c | 240 | |||

To Priyanka’s A/c | 6,000 | |||

5 | Bills Receivable A/c Dr | 12,000 | ||

To Priyanka’s A/c | 12,000 | |||

(Being new bill of remaining amount drawn and acceptance is received) | ||||

6 | Priyanka’s A/c Dr | 12,000 | ||

To Bills Receivable A/c | 12,000 | |||

(Being the bill dishonoured for non-payment) | ||||

7 | Cash A/c Dr | 6,000 | ||

Bad debts A/c Dr | 6,000 | |||

To Priyanka’s A/c | 12,000 | |||

(Being part payment received at the time of insolvency) | ||||

96240 | 96240 |

Working Note :

Calculation of interest on remaining amount ₹12,000 @ 8 % p. a. and for 3 months I = (PNR) / 100 = 12000 × (8/100) × (3/12) = ₹ 240.

Seema purchased goods from Roma on credit on 1st August, 2019 for ₹ 37,000, Seema accepts bill for 2 months drawn by Roma for the same amount on the same day Roma discounts the bill with the bank for ₹ 36,200 on 3rd August 2019. On the due date the bill is dishonoured and Noting Charges of ₹ 160 is paid by the bank. Seema pays ₹ 19,000 and Noting Charges in cash immediately. Anew bill is drawn by Roma for the balance including interest ₹ 650 for 2 months, which is accepted by Seema. The new bill is retired one month before the due date at a rebate of ₹ 300

Give Journal Entries in the Books of Seema and prepare Seema’s Account in the books of Roma.

In the books of Seema

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2019 Aug. 1 | Purchase A/c Dr | 37,000 | ||

To Roma’s A/c | 37,000 | |||

(Being goods purchased on credit) | ||||

2019 Aug. 1 | Roma’s A/c Dr | 37,000 | ||

To Bills Payable A/c | 37,000 | |||

(Being our acceptance is given) | ||||

Oct. 4 | Bills Payable A/c Dr | 37,000 | ||

To Roma’s A/c | 37,000 | |||

(Being our acceptance dishonoured) | ||||

Oct. 4 | Noting Charges A/c Dr | 160 | ||

To Roma’s A/c | 160 | |||

(Being noting charges due to Roma) | ||||

Oct. 4 | Roma’s A/c Dr | 19,160 | ||

To Cash A/c | 19,160 | |||

(Being paid part payment and noting charges in cash) | ||||

Oct. 4 | Interest A/c Dr | 650 | ||

To Roma’s A/c | 650 | |||

(Being interest amount due) | ||||

Oct. 4 | Roma’s A/c Dr | 18,650 | ||

To Bills Payable A/c | 18,650 | |||

(Being remaining due amount with interest, our acceptance is given) | ||||

Nov. 7 | Bills Payable A/c Dr | 18,650 | ||

To Cash A/c | 18,350 | |||

To Rebate A/c | 300 | |||

(Being before one month of due date, Bills payable amount paid at a rebate of L 300) | ||||

168270 | 168270 |

In the books of Roma Seema’s Account

Date | Particulars | J.F | Amount (₹) | Date | Particulars | J.F | Amount (₹) |

2019 Aug. 1 | To Sales A/c | 37,000 | 2019 Aug. 1 | By Bills Receivable A/c | 37,000 | ||

Oct. 4 | To Bank A/c (Dishonour & Noting Charges) | 37,160 | 2019 Aug 4 | By Cash A/c | 19,160 | ||

Oct. 4 | To Interest A/c | 650 | Nov. 7 | By Bills Receivable A/c (New) | 18,650 | ||

74,810 | 74,810 |

Uday purchased goods from Shankar on credit for ₹ 35,000 at 10 % Trade discount. Uday paid ₹1,500 immediately and for the balance accepted a bill for 3 months. Before the due date, Uday approached Shankar with a request to renew the bill. Shankar agreed but with condition that Uday should accept a new bill for 3 months including interest at 12 % p.a.

Give Journal Entries in the Books of Shankar.

In the books of Shankar

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

1 | Uday’s A/c Dr | 31,500 | ||

To Sales A/c | 31,500 | |||

(Being goods sold on credit @ 10 % trade discount) | ||||

2 | Cash A/c Dr. | 1,500 | ||

To Uday’s A/c | 1,500 | |||

(Being cash received from Uday) | ||||

3 | Bills Receivable A/c Dr. | 30,000 | ||

To Uday’s A/c | 30,000 | |||

(Being bill drawn and acceptance received) | ||||

4 | Uday’s A/c Dr. | 30,000 | ||

To Bills Receivable A/c | 30,000 | |||

(Being the bill cancelled at the request of Uday) | ||||

5 | Uday’s A/c Dr. | 900 | ||

To Interest A/c | 900 | |||

(Being interest amount due) | ||||

6 | New Bills Receivable A/c Dr | 30,900 | ||

To Uday’s A/c | 30,900 | |||

(Being new bill drawn with interest and acceptance received) | ||||

124800 | 124800 |

working Note :

Interest = (PNR) / 100 = 30000 × (3/12) × 12/100 = ₹ 900

Sagar drawn an after sight bill on 21st Nov. 2019 for ₹ 21,000 at 3 months on Prasad. The bill is discounted by Sagar at 8 % p. a. with his bank. On maturity, Prasad finds himself unable to make payment of the bill and requests Sagar to renew it. Sagar accepts the request and draws a new bill at one month for ₹ 21,750 including interest which was duly accepted by Prasad. Sagar deposits the bill into bank for the collection. Prasad honours the bill on the due date and Bank charges ₹ 250 as Bank Charges.

Pass necessary Journal Entries in the Books of Sagar and prepare Sagar’s account in the books of Prasad.

In the books of Sagar

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

2019 Nov. 21 | Bills receivable A/c Dr | 21,000 | ||

To Prasad’s A/c | 21,000 | |||

(Being bill drawn and acceptance received.) | ||||

2019 Nov. 21 | Bank A/c Dr | 20,580 | ||

Discount A/c Dr | 420 | |||

To Bills Receivable A/c | 21,000 | |||

(Being bill discounted with bank) | ||||

2020 Feb. 24 | Prasad’s A/c Dr | 21,000 | ||

To Bank A/c | 21,000 | |||

(Being the bill canceled) | ||||

2020 Feb. 24 | Prasad’s A/c Dr | 750 | ||

To Interest A/c | 750 | |||

(Being interest amount due) | ||||

2020 Feb. 24 | New Bills Receivable A/c Dr. | 21,750 | ||

To Prasad’s A/c | 21,750 | |||

(Being new bill drawn and acceptance received) | ||||

2020 Feb. 24 | Bill Sent for Collection A/c Dr | 21,750 | ||

To New Bills Receivable A/c | 21,750 | |||

(Being new bill sent for collection to bank) | ||||

Mar. 27 | Bank A/c Dr | 21,500 | ||

Bank Charges A/c Dr | 250 | |||

To Bill sent for collection A/c | 21,750 | |||

(Being the amount of the bill collected by the bank and credited to our Account by deducting bank charges) | ||||

129000 | 129000 |

Dr | In the books of Prasad Sagar’s Account | cr | |||||

Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

2019 Nov. 21 | To Bills Payable A/c (Acceptance given) | 21,000 | 2019 Nov. 21 | By Balance b/d | 21,000 | ||

2019 Nov. 24 | To Bill Payable A/c (New acceptance given) | 21,750 | Feb. 24 | By Bills Payable A/c (Dishonour) | 21,000 | ||

Feb. 24 | By Interest A/c (Int. due) | 750 | |||||

42,750 | 42,750 |

Journalise the following transaction in the books of Abhishek:-

a) Siddhant informs Abhishek that Vineet’s acceptance for ₹ 23,000 endorsed to Siddhant has been dishonoured. Nothing Charges amounted to ₹ 430.

b) Kajal renews her acceptance to Abhishek for ₹ 39,000 by paying 3,000 in cash and accepting a fresh bill for the balance along with interest at 11.5 % p.a. for 3 months.

c) Radhika retired her acceptance to Abhishek for ₹ 23,000 by paying ₹ 22,250 by cheque.

d) Abhishek sent a bill of Subodh for ₹ 9,000 to bank for collection. Bank informed that the bill has been dishonoured by Subodh.

In the books of Abhishek

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

(a) | Vineet’s A/c Dr | 23,430 | ||

To Siddhant’s A/c | 23,430 | |||

(Being Vineet’s acceptance endorsed to Siddhant dishonoured and noting charges amount is included) | ||||

(b) (i) | Kajal’s A/c Dr. | 39,000 | ||

To Bills Receivable A/c | 39,000 | |||

(Being cancellation of bill) | ||||

(ii) | Cash A/c Dr. | 3,000 | ||

To Kajal’s A/c | 3,000 | |||

(Being cash received from Kajal) | ||||

(iii) | Kajal’s A/c Dr | 1,035 | ||

To Interest A/c | 1,035 | |||

(Being interest amount due) | ||||

(iv) | New Bills Receivable A/c Dr. | 37,035 | ||

To Kajal’s A/c | 37,035 | |||

(Being new bill drawn and acceptance is received) | ||||

(c) | Bank A/c Dr | 22,250 | ||

Rebate A/c Dr | 750 | |||

To Bills Receivable A/c | 23,000 | |||

(Being Radhika retired her acceptance) | ||||

(d) (i) | Bill Sent for Collection A/c Dr. | 9,000 | ||

To Bills Receivable A/c | 9,000 | |||

(Being Subodh’s acceptance sent to bank for collection) | ||||

(ii) | Subodh’s A/c Dr | 9,000 | ||

To Bill Sent for collection A/c | 9,000 | |||

(Being Subodh’s acceptance dishonoured.) | ||||

144500 | 144500 |

Working Note :

Amount of interest = 36000 × (3/12) × (11.5/100) = ₹ 1035.

Journalise the following transactions in the books of Narendra: -

a) Narendra retires his acceptance to Upendra by paying ₹ 4,000 in cash and endorsing a bill accepted by Ramlal for ₹ 5,000.

b) Vikram’s acceptance to Narendra ₹ 6,000 retired one month before the due date at rebate of 12% p.a.

c) Dilip renews his acceptance to Narendra for ₹ 12,000 by paying ₹ 4,000 in cash and accepting a fresh bill for the balance plus interest at 12% p.a. for 3 months.

d) Bank informed Narendra that, Kartik’s acceptance for ₹ 13,000 to Narendra, discounted with the bank was dishonoured and Noting Charges paid by bank ₹ 140.

In the books of Narendra

Journal Entries

Date | Particulars | L.F. | Debit (₹) | Credit (₹) |

(a) | Bills Payable A/c Dr | 9,000 | ||

To Cash A/c | 4,000 | |||

To Bills Receivable A/c | 5,000 | |||

(Being Upendra’s dues cleared by paying cash and endorsing a bill) | ||||

(b) | Cash A/c Dr | 5,940 | ||

Rebate A/c Dr | 60 | |||

To Bills Receivable A/c | 6,000 | |||

(Being Vikram’s acceptance retired with rebate) | ||||

(c) (i) | Dilip’s A/c Dr | 12,000 | ||

To Bills Receivable A/c | 12,000 | |||

(Being cancellation of bill) | ||||

(ii) | Cash A/c Dr | 4,000 | ||

To Dilip’s A/c | 4,000 | |||

(Being cash received) | ||||

(iii) | Dilip’s A/c Dr | 240 | ||

To Interest A/c | 240 | |||

(Being interest due) | ||||

(iv) | Bills Receivable A/c Dr. | 8,240 | ||

To Dilip’s A/c | 8,240 | |||

(Being fresh bill accepted by Dilip for remaining amount plus interest) | ||||

(d) | Kartik’s A/c Dr. | 13,140 | ||

To Bank A/c | 13,140 | |||

(Being Kartik’s acceptance dishonoured and bank paid noting charges) | ||||

52620 | 52620 |

Journalise the following transactions in the books of Bharti:-

a) Bank informed that Amit’s acceptance for ₹15,750 sent to bank for collection was honoured and bank charges debited were ₹ 150.

b) Nitin renewed his acceptance for ₹ 22,200 by paying ₹ 2,200 in cash along with interest on balance amount at 10% and accepted a fresh bill for the balance for 3 months.

c) Dhanshri who had accepted Bharti’s bill for ₹ 17,500 was declared insolvent and only 40% of the amount due could be recovered from his estate.

d) Discharged our acceptance to Savita for ₹ 9,450 by endorsing Pravin’s acceptance to us ₹ 9,000.

In the books of Bharti

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

(a) | Bank A/c Dr | 15,600 | ||

Bank Charges A/c Dr. | 150 | |||

To Bill sent for collection A/c | 15,750 | |||

(Being the amount of Bill collected by bank and credited to our Bank A/c and Bank Charges debited) | ||||

(b) (i) | Nitin’s A/c Dr | 22,200 | ||

To Bills Receivable A/c | 22,200 | |||

(Being cancellation of bill) | ||||

(ii) | Nitin’s A/c Dr | 500 | ||

To Interest A/c | 500 | |||

(Being interest amount due) | ||||

(iii) | Cash A/c Dr | 2,700 | ||

To Nitin’s A/c | 2,700 | |||

(Being part payment along with interest received) | ||||

(iv) | Bills Receivable A/c Dr. | 20,000 | ||

To Nitin’s A/c | 20,000 | |||

(Being the acceptance received for balance amount due) | ||||

(c) (i) | Dhanshri’s A/c Dr. | 17,500 | ||

To Bills Receivable A/c | 17,500 | |||

(Being bill dishonoured for non-payment) | ||||

(ii) | Cash A/c Dr. | 7,000 | ||

Bad Debts A/c Dr | 10,500 | |||

To Dhanshri’s A/c | 17,500 | |||

(Being 40 % due amount received from Dhanshri, as being declared insolvent) | ||||

(d) | Bills Payable A/c Dr. | 9,450 | ||

To Discount A/c | 450 | |||

To Bills Receivable A/c | 9,000 | |||

(Being our acceptance Savita i.e. B. P. is cleared by endorsing Pravin’s acceptance i.e. B. R.) | ||||

105600 | 105600 |

Journalise the following transactions in the books of Sudha:-

a) Endorsed Sonali’s acceptance at 2 months for ₹ 6,000 in favour of Urmila and paid cash ₹ 3,500 in full settlement of her account ₹ 10,000.

b) Discounted 2 months acceptance of Surya for ₹ 7,800 with bank at 10% p.a.

c) Bank informed that Anuradha’s acceptance of ₹ 4,800 which was discounted was dishonoured and bank paid Noting Charges ₹ 125.

d) Pooja honoured her acceptance of ₹ 16,400 which was deposited into bank for collection.

In the books of Sudha

Journal Entries

Date | Particulars | L.F | Debit (₹ ) | Credit (₹ ) |

(a) | Urmila’s A/c Dr. | 10,000 | ||

To Cash A/c | 3,500 | |||

To Discount A/c | 500 | |||

To Bills Receivable A/c | 6,000 | |||

(Being Sonali’s acceptance endorsed in favour of Urmila with cash to clear her debt) | ||||

(b) | Bank A/c Dr | 7,670 | ||

Discount A/c Dr | 130 | |||

To Bills Receivable A/c | 7,800 | |||

(Being discounted Surya’s acceptance with bank) | ||||

(Hint : 7,800×10100×212 = ₹ 130) | ||||

(c) | Anuradha’s A/c Dr. | 4,925 | ||

To Bank A/c | 4,925 | |||

(Being discounted bill dishonoured and noting charges paid by bank) | ||||

(d) | Bank A/c Dr | 16,400 | ||

To Bill Sent for Collection A/c | 16,400 | |||

(Being amount of the bill collected and credited in our bank account) | ||||

39125 | 39125 |

Journalise the following transactions in the books of Mrunal:-

a) Bank informed that Aishwarya’s acceptance of ₹ 24,000 which was discounted had been dishonoured and bank paid Noting Charges ₹ 220. Bill was renewed at the request of Aishwarya for 2 months with interest of ₹ 480.

b) Received ₹ 4,630 from private estate of Ankur who was declared insolvent against bill accepted by him for ₹ 6,000.

c) Accepted a bill of ₹ 15,000 at 3 months drawn by Anushka for the amount due to her ₹ 20,000 and balance paid by cheque.

d) Dishonoured our acceptance to Vivek ₹ 27,000 and Noting Charges paid by Vivek ₹ 700

In the books of Mrunal

Journal Entries

Date | Particulars | L.F | Debit (₹) | Credit (₹) |

(a) (i) | Aishwarya’s A/c Dr. | 24,000 | ||

To Bank A/c | 24,000 | |||

(Being discounted bill dishonoured) | ||||

(ii) | Aishwarya’s A/c Dr | 220 | ||

To Bank A/c | 220 | |||

(Being noting charges paid and adjusted) | ||||

(iii) | Aishwarya’s A/c Dr. | 480 | ||

To Interest A/c | 480 | |||

(Being interest amount due) | ||||

(iv) | Bills Receivable A/c Dr | 24,700 | ||

To Aishwarya’s A/c | 24,700 | |||

(Being new acceptance received from Aishwarya for balance receivable) | ||||

(b) | Cash A/c Dr | 4,630 | ||

Bad Debts A/c Dr | 1,370 | |||

To Ankur’s A/c | 6,000 | |||

(Being cash received and write off remaining amount of Ankur) | ||||

(c) | Anushka’s A/c Dr | 20,000 | ||

To Bank A/c | 5,000 | |||

To Bills Payable A/c | 15,000 | |||

(Being cash received and write off remaining amount of Ankur) | ||||

(d) | Bills Payable A/c Dr. | 27,000 | ||

Noting Charges A/c Dr | 700 | |||

To Vivek’s A/c | 27700 | |||

(Being our acceptance dishonoured and Vivek paid noting charges) | ||||

103100 | 103100 |

Book-keeping and Accountancy 12th Standard

HSC Maharashtra State Board. Latest Syllabus.

Chapter 1: Introduction to Partnership and Partnership Final Accounts

Chapter 2: Accounts of ‘Not for Profit’ Concerns

Chapter 3: Reconstitution of Partnership (Admission of Partner)

Chapter 4: Reconstitution of Partnership (Retirement of Partner)

Chapter 5: Reconstitution of Partnership (Death of Partner)

Chapter 6: Dissolution of Partnership Firm

Chapter 8: Company Accounts - Issue of Shares

Chapter 9: Analysis of Financial Statements

Chapter 10: Computer In Accounting

ACCOUNTS BOARD PAPERS

HSC Accounts March 2020 Board Paper With Solution

MARCH 2014 : View | PDF Download

OCTOBER 2014 View | PDF Download

MARCH 2015 View | PDF Download

JULY 2015 View | PDF Download

MARCH 2016 View | PDF Download

JULY 2016 View | PDF Download

JULY 2017 View | PDF Download

MARCH 2017 View | PDF Download

MARCH 2018 View | PDF Download

JULY 2018 View | PDF Download

MARCH 2019 View | PDF Download

MARCH 2020 View | PDF Download

.