Book Keeping, Accountancy, 12th Std, HSC Accounts, Death of Partner,

Chapter 5, Reconstitution of Partnership (Death of Partner)

Practical Problems | Q 3 | Page 203

Ram, Madhav, and Keshav are partners sharing Profit and Losses in the ratio 5:3:2 respectively. Their Balance Sheet as on 31st March 2018 was as follows.

Balance Sheet as on 31st March 2018

Keshav died on 31 July 2018 and the following Adjustment were agreed by as per partnership deed.

1. Creditors have increased by 10,000

2. Goodwill is to be calculated at 2 years purchase of average profits of 5 years.

3. The Profits of the preceding 5 years was

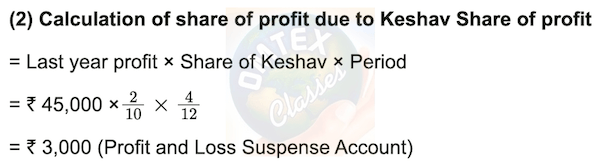

Keshav's share in it was to be given to him.

4. Loose Tools and livestock were valued at ₹ 80,000 and ₹ 1,20,000 respectively

5. R.D.D. was maintained at ₹ 10,000

6. Commission's ₹ 2000 p.m. was payable to Keshav Profit for 2018 -19 was estimated at ₹ 45000 and Keshav's share in it up to the date of his death was given to him.

Prepare

Revaluation A/c, Keshav’s capital A/c showing the amount payable to his executors.

Solution

In the books of the Partnership Firm Revaluation Account

Keshav’s Capital Account

Book-keeping and Accountancy 12th Standard

HSC Maharashtra State Board. Latest Syllabus.

Chapter 1: Introduction to Partnership and Partnership Final Accounts

Chapter 2: Accounts of ‘Not for Profit’ Concerns

Chapter 3: Reconstitution of Partnership (Admission of Partner)

Chapter 4: Reconstitution of Partnership (Retirement of Partner)

Chapter 5: Reconstitution of Partnership (Death of Partner)

Chapter 6: Dissolution of Partnership Firm

Chapter 8: Company Accounts - Issue of Shares

Chapter 9: Analysis of Financial Statements

Chapter 10: Computer In Accounting

ACCOUNTS BOARD PAPERS

HSC Accounts March 2020 Board Paper With Solution

MARCH 2014 : View | PDF Download

OCTOBER 2014 View | PDF Download

MARCH 2015 View | PDF Download

JULY 2015 View | PDF Download

MARCH 2016 View | PDF Download

JULY 2016 View | PDF Download

JULY 2017 View | PDF Download

MARCH 2017 View | PDF Download

MARCH 2018 View | PDF Download

JULY 2018 View | PDF Download

MARCH 2019 View | PDF Download

MARCH 2020 View | PDF Download