Book Keeping, Accountancy, 12th Std, HSC Accounts, Death of Partner,

Chapter 5, Reconstitution of Partnership (Death of Partner)

Practical Problems | Q 4 | Page 204

Virendra, Devendra, and Narendra were partners sharing Profit and Losses in the ratio of 3:2:1. Their Balance Sheet as on 31st March 2019 was as follows.

Balance Sheet as on 31st March 2019

Mr. Virendra died on 31st August 2019 and the Partnership deed provided that. That the event of the death of Mr. Virendra his executors be entitled to be paid out.

1. The capital to his credit at the date of death.

2. His proportion of Reserve at the date of the last Balance sheet.

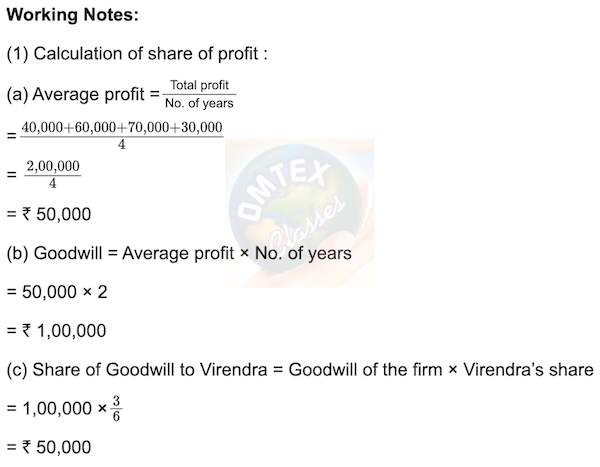

3. His proportion of Profits to date of death based on the average profits of the last four years.

4. His share of Goodwill should be calculated at two years purchase of the profits of the last four years for the year ended 31st March were as follows -

5. Mr. Virendra has drawn ₹ 3000 p.m. to date of death, There is no increase and Decrease the value of assets and liabilities.

Prepare Mr. Virendras Executors A/c

Solution

In the books of the Partnership Firm Virendra’s Capital Account