12th SP Chapter 7 Solution (Correspondence with Debentureholders) – Maharashtra Board – Free Solution

12th SP Chapter 7 Solution

Chapter 7 – Correspondence with Debentureholders

Q.1 A) Select the correct answer from the options given below and rewrite the statements.

1) Debenture capital is a _____ capital of a company.

a) borrowed

b) owned

c) permanent

2) Debentureholders are _____ of the company.

a) Owners

b) Creditors

c) Debtors

3) Borrowed Capital is provided to the company by _____.

a) Equity shareholder

b) Debenture Holder

c) Preference shareholder

4) Interest on Registered Debentures is given through _____.

a) Interest coupons

b) Interest warrant

c) Refund order

5) _____ are the creditors of the company.

a) Shareholders

b) Debentureholders

c) Directors

6) Bearer Debentureholders get interest through _____.

a) Interest Warrants

b) Refund orders

c) Interest coupons

7) Return of income on debentures is _____ at fixed rate.

a) Dividend

b) Loan

c) Interest

8) _____ is an acknowledgement of debt issued b the company under common seal.

a) Debentures

b) Shares

c) Reserve

9) Debentures repayable after a certain period are _____ debentures.

a) Convertible

b) Registered

c) Redeemable

10) The rate of interest payable on debentures is _____.

a) uncertain

b) floating

c) fixed

11) Debentureholders receive _____ certificate from the company.

a) Share

b) Bond

c) Debenture

12) Interest warrants are sent to _____ of the company.

a) Shareholders

b) Debentureholders

c) Owners

Q.1 B) Match the pairs.

Answers.

a. 9) Creditor

b. 5) Interest warrant

c. 10) Conversion into equity shares

d. 3) Evidence of Loan

e. 4) Safe and secure investment

f. 11) Redeemed after fixed period

g. 1) Borrowed Capital

Q.1 C) Write a word or a term or a phrase which can substitute each of the following statements.

1) Return on investment in debentures.

Ans: Interest

2) Documentary evidence of holding the debentures.

Ans: Debenture Certificate

3) Status of debenture holders.

Ans: Creditors

4) Debentures which can be converted into equity shares.

Ans: Convertible Debenture

5) The person who purchases debentures of the company.

Ans: Debenture Holder

6) An acknowledgment of debt issued b the company under its common seal.

Ans: Debenture Certificate

7) Debentures whose name is mentioned in the Register of debenture holders.

Ans: Registered Debentures

Q.1 D) State whether the following statements are true or false.

1) Debentureholders get regular dividend.

Ans: False

2) Debenture is a loan capital of the company.

Ans: Ture

3) Convertible Debentures can be converted into equity shares.

Ans: True

4) Interest on debentures is paid notwithstanding the volume of profit.

Ans: Ture

5) Debentureholders enjoy full membership rights of the company.

Ans: False

6) Dividend warrants are used to pay interest to the debenture holders.

Ans: False

7) All types of debentures are eligible for conversion into equity shares.

Ans: False

8) Debentures are never redeemed by the company.

Ans: False

9) Debenture holders are the owners of the company.

Ans: False

10) Debentures are always fully paid up.

Ans: Ture

Q.1 E) Find the odd one.

Depository, Interest, Dividend

Interest warrant, Dividend Warrant, Demat

Debenture holder, Shareholder, Dematerialisation

Debenture holder, Shareholder, SEBI

Q.1 F) Complete the sentences.

1) Debentureholder is a creditors of the company.

2) Company issues debenture certificate to the debentureholder after allotment of debentures.

3) Debentureholder gets Interest at fixed rate as a return or income.

4) In the case of Registered Debentures, Interest Warrant are used to pay interest.

5) The Secretary has to correspond with debentureholders on important occasions.

6) The person who purchases the debentures of a company is called Debentureholder .

7) Interest does not depend upon profit of the company.

8) Company cannot issue debentures with voting rights.

9) Debenture certificate should be issued within a period of 6 months, from the date of allotment of debentures.

10) A company cannot issue debentures to more than 500 people without appointing a Debenture Trustee.

11) The power to issue debentures has been vested with the Board of Directors.

Q.1 G) Select the correct option from the bracket.

Q.1 H) Answer in one sentence.

1) Who is debenture holder?

Answer: These are the parties who provide loan and receive, a ‘Debenture Certificate’ as evidence.

The person who purchases debentures of the company is called debentureholder.

2) What is the income of the debenture holder?

Answer: Debentureholders receive interest as an income.

3) What is a debenture?

Answer: A debenture is a document given by a company as evidence of debt to the holder, usually arising out of loan, and most commonly secured by charge.”

4) What are convertible Debentures?

Answer: Convertible debentures give right to holder to convert them into equity shares after a specific period of time.

5) Who takes decision to allot the debentures ?

Answer: The Board of Directors take the decision to allot debentures.

6) Which form is enclosed along with the letter of redemption of debentures?

Answer: Debenture Redemption form is enclosed along with the letter of redemption of debentures.

7) Which certificate will be issued after allotment of debentures?

Answer: A debenture certificate will be issued after the allotment of debentures.

Q.1 I) Correct the underlined word/s and rewrite the following sentences.

1) The person who purchases debentures of the company is called shareholder.

Answer: Debentureholder.

2) Debentureholders get regular dividend at fixed rate.

Answer: Interest.

3) A Share Certificate must be issued after allotment of debentures.

Answer: Debenture Certificate.

4) A Debenture Redemption Reserve Fund is created b the company for the redemption of Shares.

Answer: Debentures

5) A Demat Request Form is sent along with the letter of Redemption of Debentures.

Answer: Debenture Redemption Form

6) A company must issue a Debenture Certificate within 8 months of allotment of debentures.

Answer: 6

Q.1 J) Arrange in proper order

1)

a) Board Resolution

b) Allotment of Debentures

c) Board meeting

Answer: (c) Board meeting (a) Board Resolution (b) Allotment of Debentures

2)

a) Interest warrant

b) Allotment of Debentures

c) Board meeting

Answer: (c) Board meeting (b) Allotment of Debentures (a) Interest warrant

Q.2 Explain the following terms/concepts.

1) Debentures:

Answer: a) A debenture is a document given by a company as evidence of debt to the holder, usually arising out of loan, and most commonly secured b charge.”

b) According to the above definitions, debenture is evidence of indebtedness. It is an instrument issued in the form of debenture certificate, under the common seal of the company.

c) A fixed rate of interest is agreed upon and is paid periodically in case of debentures.

2) Debentureholder:

Answer: a) These are the parties who provide loan and receive, ‘Debenture Certificate’ as an evidence.

b) Debenture Holder is a creditor of the company. Since debenture is a loan taken by company, interest is payable on it at fixed rate, at fixed interval until the debenture is redeemed.

c) Debentureholders have no right to vote at the general meeting of the company.

3) Interest on Debentures:

Answer: a) A fixed rate of interest is agreed upon and is paid periodically in case of debentures.

b) Payment of interest is a fixed liability of the company.

c) It must be paid by company irrespective of the fact, whether the company makes profit or not.

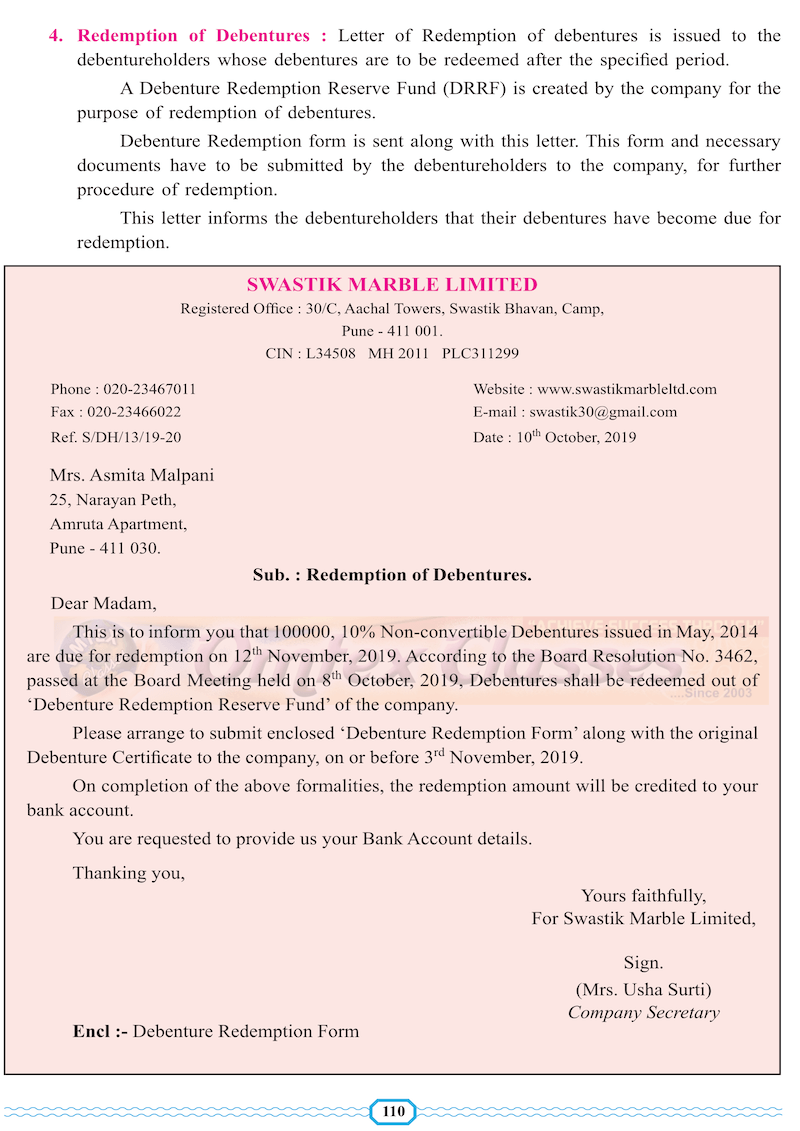

4) Redemption of Debentures:

Answer: a) Redemption of Debentures means repayment of the amount of debentures by the company to debenture holders.

b) Repayment can be made at fixed date at the end of a specific period or b installment during the lifetime of the company.

c) A Debenture Redemption Reserve Fund (DRRF) is created b the company for the purpose of redemption of debentures. The debenture Redemption form is sent along with this letter.

5) Conversion of Debentures:

Answer: a) Convertible Debentures are the debentures that are converted into equity shares on the expiry of a specified period and at a specified rate mentioned in the terms of issue.

b) After receiving Letter of Option, the secretary sends a letter informing the debenture holders that the debentures are converted into equity shares.

c) Company has to get approval of shareholders by passing special resolution at the Extra Ordinary General Meeting for conversion of debentures into equity shares.

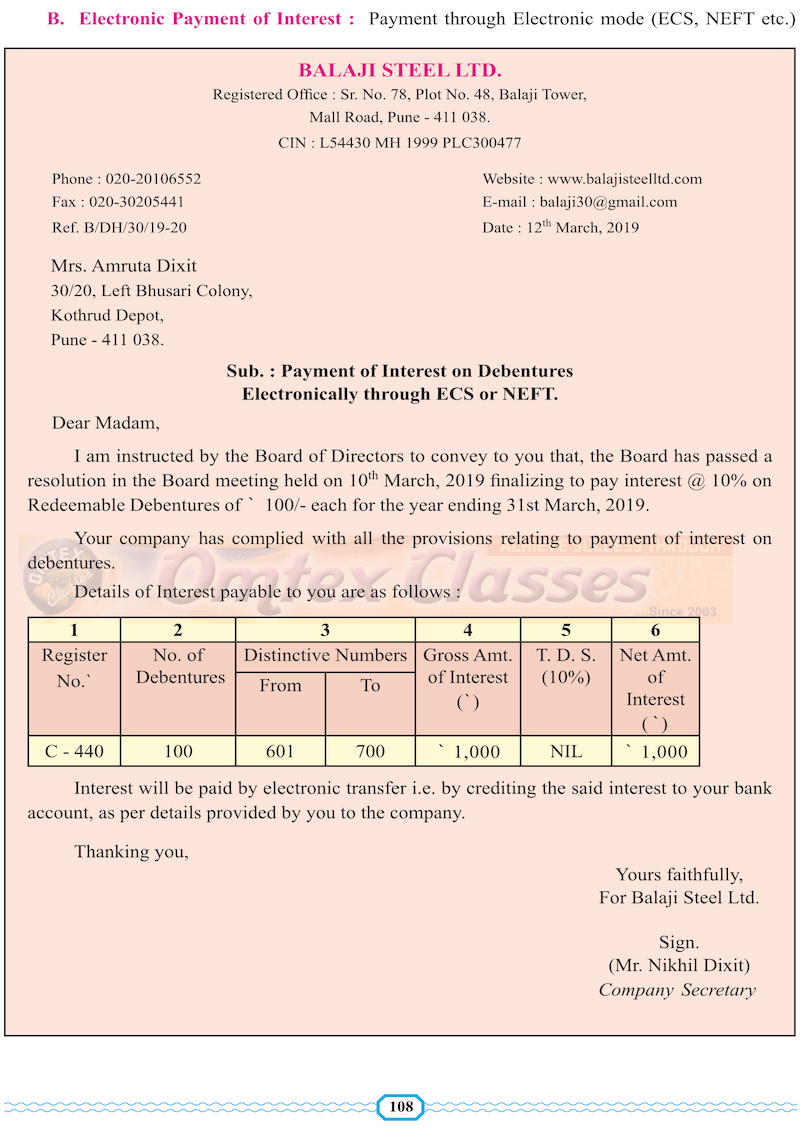

6) Interest warrant:

Answer: a) Interest Warrants are used to pay interest to the debenture holders.

b) An interest warrant is a written order given by the company to its banker to pay the amount mentioned in it to the debenture holder.

7) Conciseness:

Answer: a) The Secretary has to communicate the decisions of the management and other information

to the Debenture holders by conducting correspondence.

b) The letter to the debenture holders should be concise i.e. brief, short, and to the point. Unnecessary and irrelevant information must be avoided.

8) Precise information:

Answer: a) Secretary should be very cautious and careful while corresponding with debenture holders of the company.

b) The Secretary should provide precise and up-to-date information to the debenture holders. The information must be factual and true.

9) Courtesy:

Answer: a) Being the creditors, due respect should be given to the debenture holder in secretarial correspondence.

b) The tone of language in the letter should be courteous. Rude and harsh language should be strictly avoided.

10) Debenture certificate:

Answer: a) Debenture certificate is a formal document issued by the company acknowledging a debt and a written promise given by the company.

b) Debentures are issued with the due date stated in the debenture certificate. The principal amount of the debenture is repaid on the maturity date.

Q.3 Answer in brief.

1) Which are the precautions to be taken by the Secretary while corresponding with Debentureholders?

Answer: The following precautions are to be kept in mind by the Secretary while corresponding with the debenture holders.

1) Politeness (Courtesy): Being the creditors, due respect should be given to the debenture holder in secretarial correspondence. The tone of language in the letter should be courteous. Rude and harsh language should be strictly avoided.

2) Prompt Response: The Secretary should promptly reply and respond to the queries and complaints of the debenture holders without any delay.

3) Legal provisions: The Secretary should follow the statutory provisions of the Companies Act, 2013 and other relevant laws while corresponding with debenture holders. Secretary should be cautious and careful while corresponding with debenture holders on legal matters.

4) Transparency: To maintain greater transparency with debenture holders, it is necessary to disclose all correct and accurate information of the company, credit rating of the company, true and real facts of companies affairs, etc. in correspondence.

5) Conciseness: The letter to the debenture holders should be concise i.e. brief, short, and to the point. Unnecessary and irrelevant information must be avoided.

6) Precise Information: The Secretary should provide precise and up-to-date information to the debenture holders. The information must be factual and true.

7) Secrecy: As a confidential officer of the company, the secretary should not disclose important and secret information related to the company while corresponding with debenture holders.

8) Image and Goodwill of the company: While corresponding with debenture holders, the Secretary should always try to maintain goodwill and create a good image of the company in the mind of debenture holders.

2) What are the circumstances under which correspondence can be made with the debenture holder?

Answer: The following are the few circumstances under which the Secretary enters into correspondence

with the debenture holder.

Informing the applicant about allotment of debentures.

Informing about Payment of Interest though :

a) Interest Warrant

b) Electronic Payment of InterestLetter for conversion of debentures into equity shares.

Letter for the redemption of debentures.

Q.4 Justify the following statements.

1) The Company Secretary should take certain precautions while corresponding with Debenture holders.

Answer: The following precautions are to be taken by the Secretary while corresponding with Debentureholder.

1) Politeness (Courtesy): Being the creditors, due respect should be given to the debenture holder in secretarial correspondence. The tone of language in the letter should be courteous. Rude and harsh language should be strictly avoided.

2) Prompt Response: The Secretary should promptly reply and respond to the queries and complaints of the debenture holders without any delay.

3) Legal provisions: The Secretary should follow the statutory provisions of the Companies Act, 2013 and other relevant laws while corresponding with debenture holders. Secretary should be cautious and careful while corresponding with debenture holders on legal matters.

4) Transparency: To maintain greater transparency with debenture holders, it is necessary to disclose all correct and accurate information of the company, credit rating of the company, true and real facts of companies affairs, etc. in correspondence.

2) There are certain circumstances when a Secretary has to correspond with Debenture holders.

Answer: The following are the few circumstances under which the Secretary enters into correspondence

with the debenture holder.

Informing the applicant about allotment of debentures.

Informing about Payment of Interest though :

a) Interest Warrant

b) Electronic Payment of InterestLetter for conversion of debentures into equity shares.

Letter for the redemption of debentures.

Q.5 Answer the following

1) Draft a letter of allotment to the debenture holder.

Answer: For answer refer to page no. 106 of Textbook.

2) Write a letter to the debenture holder regarding payment of interest through Interest Warrant.

Answer: For answer refer to page no. 107 of Textbook.

3) Draft a letter to debenture holder informing him about redemption of debentures.

Answer: For answer refer to page no. 110 of Textbook.

4) Write a letter to debenture holder informing him about conversion of debentures into equity shares.

Answer: For answer refer to page no. 109 of Textbook.

5) Write a letter to the debenture holder regarding payment of interest electronically.

Answer: For answer refer to page no. 108 of Textbook.