Instructions: Answer the following questions in 2-3 sentences each.

1.

What is the difference between subscribed capital and paid-up capital?

2.

Why is a Current Account said to “always show a debit balance”?

3.

In the absence of a partnership agreement, what is the default interest rate allowed on a loan advanced by a partner to the firm?

4.

To which account is the balance of a retired partner transferred if it's not paid immediately?

5.

What type of account is the Income and Expenditure Account?

6.

What is a Tally software classified as?

7.

Define the term “liquid asset”.

8.

What happens to the Cash or Bank account on dissolution of a firm?

9.

If an asset is taken over by a partner during dissolution, which account is debited?

10.

What is the purpose of a Realisation Account?

Answer Key

1.

Subscribed capital is the total amount of capital that shareholders have agreed to contribute to a company. Paid-up capital is the portion of the subscribed capital that has actually been paid by shareholders.

2.

A current account typically maintains a debit balance because it represents the amount the account holder owes to the bank. It is a running account used for frequent transactions, with the expectation of repayment.

3.

In the absence of a partnership agreement, the default interest rate allowed on a loan advanced by a partner to the firm is 6%. This is a statutory provision to ensure fair compensation for the lending partner.

4.

The balance of a retired partner, if not paid immediately, is transferred to his/her Loan Account. This account reflects the outstanding amount owed by the firm to the retired partner.

5.

The Income and Expenditure Account is a Nominal Account. It is used to track the income and expenses of a non-profit organization over a specific period.

6.

Tally software is classified as Accounting Software. It is a popular accounting program used by businesses to manage their financial records.

7.

A liquid asset is an asset that can be quickly converted into cash without significant loss of value. Examples include cash, marketable securities, and short-term investments.

8.

On the dissolution of a firm, the Cash or Bank account is closed automatically. All remaining assets are realized, liabilities are settled, and the surplus is distributed among partners based on their profit-sharing ratio.

9.

If an asset is taken over by a partner during dissolution, the Revaluation Account is debited. The asset's value is adjusted to reflect its current market worth, and the corresponding partner's capital account is credited.

10.

The purpose of a Realisation Account is to record the process of converting assets into cash and settling liabilities during the dissolution of a firm. It helps determine the profit or loss on realization, which is then distributed among the partners.

Essay Questions

1.

Explain the process of admitting a new partner into a firm. Discuss the necessary adjustments to be made in the books of accounts and the calculation of goodwill.

2.

Describe the steps involved in preparing a partnership firm's final accounts upon dissolution. Include the preparation of the Realisation Account, Partners' Capital Accounts, and the Bank Account.

3.

Discuss the features and advantages of using Computerized Accounting Systems over manual bookkeeping methods. How do these systems benefit businesses in managing their financial records efficiently?

4.

Explain the concept of a Receipts and Payments Account. How does it differ from an Income and Expenditure Account? Provide examples to illustrate the differences.

5.

Discuss the various adjustments that are typically made while preparing a Profit and Loss Account and Balance Sheet. Explain the rationale behind each adjustment and its impact on the final financial statements.

Glossary of Key Terms

●

Subscribed Capital: The total amount of capital that shareholders have agreed to contribute to a company.

●

Paid-up Capital: The portion of the subscribed capital that has actually been paid by shareholders.

●

Current Account: A bank account used for frequent transactions, allowing deposits and withdrawals.

●

Loan Account: An account that reflects the amount owed by one party (debtor) to another (creditor).

●

Nominal Account: An account used to track income, expenses, gains, and losses over a specific period.

●

Accounting Software: Computer programs designed to manage and process financial transactions.

●

Liquid Asset: An asset easily convertible into cash without significant loss of value.

●

Dissolution of Firm: The termination of a partnership agreement and the cessation of business operations.

●

Revaluation Account: An account used to record adjustments in the value of assets and liabilities.

●

Realisation Account: An account used to record the conversion of assets into cash and settlement of liabilities during dissolution.

●

Goodwill: An intangible asset representing the value of a firm's reputation and customer relationships.

●

Partners' Capital Account: An account that tracks the capital contributions and withdrawals of each partner in a firm.

●

Computerized Accounting System: An accounting system that uses computer software to manage financial records.

●

Receipts and Payments Account: A summary of all cash and bank transactions over a period.

●

Income and Expenditure Account: An account used to track income and expenses of non-profit organizations.

●

Profit and Loss Account: A financial statement showing a company's revenues, expenses, and net income over a period.

●

Balance Sheet: A financial statement showing a company's assets, liabilities, and equity at a specific point in time.

●

Trial Balance: A list of all the debit and credit balances in a company's ledger accounts.

●

Prepaid Expense: An expense paid in advance for services or goods to be received in the future.

●

Depreciation: The allocation of the cost of a tangible asset over its useful life.

●

Reserve for Doubtful Debts (R.D.D.): An estimated amount set aside to cover potential losses from uncollectible accounts receivable.

●

Closing Stock: The value of inventory remaining at the end of an accounting period.

Key Themes and Concepts:

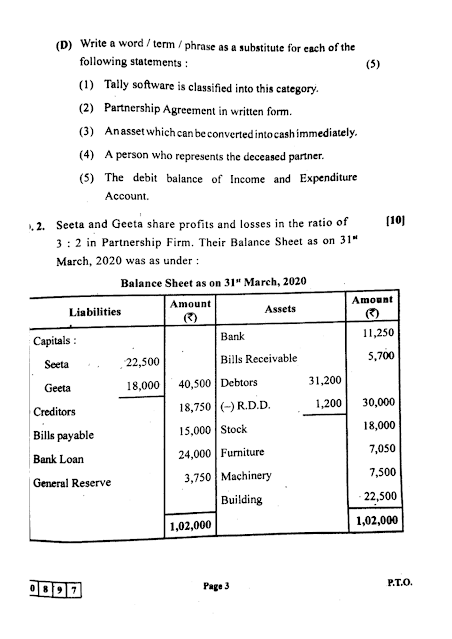

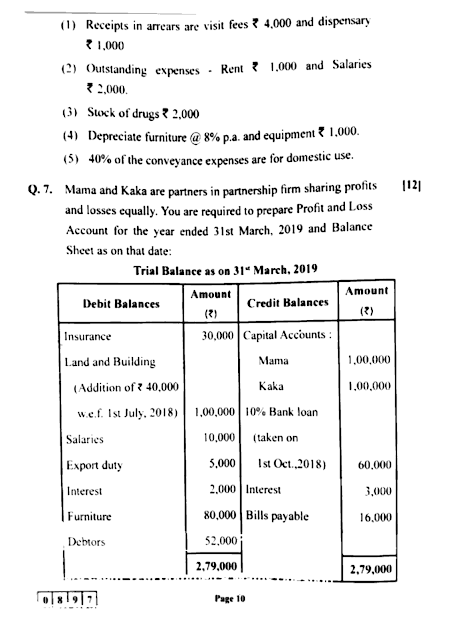

- Partnership Accounting: A significant focus lies on partnership accounting, covering topics such as admission and retirement of partners, goodwill calculation, and dissolution of a firm. The sources delve into the accounting procedures for these events, emphasizing the adjustments needed in various accounts, including the Realization Account and Partners' Capital Accounts.

- Example: "The balance of a retired partner, if not paid immediately, is transferred to his/her Loan Account. This account reflects the outstanding amount owed by the firm to the retired partner." (Study Guide)

- Financial Statements: Both sources highlight the importance of preparing accurate financial statements. The study guide explains concepts related to the Profit and Loss Account, Balance Sheet, and Trial Balance, while the exam paper tests students on their ability to apply these concepts in practical scenarios.

- Computerized Accounting Systems: The study guide emphasizes the advantages of using computerized accounting systems over manual methods. It touches upon the features and benefits of such systems, while the exam paper presents a case study requiring the conversion of manual accounting data into a computerized format.

- Distinctive Account Types: The sources dedicate sections to understanding specific accounts like the Receipts and Payments Account, contrasting it with the Income and Expenditure Account. The exam paper presents scenarios requiring the preparation of these accounts, demonstrating their practical applications.

Important Facts and Definitions:

The sources provide a glossary of key terms essential for understanding bookkeeping and accountancy. These include:

- Subscribed Capital: The total capital committed by shareholders.

- Paid-up Capital: The portion of subscribed capital actually paid.

- Liquid Asset: Asset easily convertible to cash without significant loss.

- Goodwill: Intangible asset representing a firm's reputation and relationships.

- Nominal Account: Tracks income, expenses, gains, and losses.

Practical Applications:

The exam paper utilizes numerous practical problems to test students' understanding. These problems involve:

- Admission of a new partner: Calculating goodwill, adjusting capital accounts.

- Dissolution of a firm: Preparing a Realisation Account and closing procedures.

- Journalizing Transactions: Recording financial transactions in a journal.

- Preparing Financial Statements: Constructing a Profit and Loss Account and Balance Sheet from given data.

Quotes:

- "On the dissolution of a firm, the Cash or Bank account is closed automatically." (Study Guide) This quote emphasizes the automatic closure of cash accounts upon a firm's dissolution.

- "A Bill of Exchange is a conditional order." (Exam Paper) This statement defines a Bill of Exchange as a conditional financial instrument.

Overall:

The sources provide a thorough grounding in essential bookkeeping and accountancy principles. The study guide acts as a foundational resource, while the exam paper serves as a practical assessment tool. This combination effectively teaches and tests the application of key accounting concepts.